Trade Receivables Debit or Credit

Manfredis account in the receivables ledger post-payment. For example you may have purchased materials from a vendor but after receiving the materials found that they were defective in.

Trade Receivables And Revenue Acca Global

Ending beginning - reduce allowance - debit allowance and credit BDE.

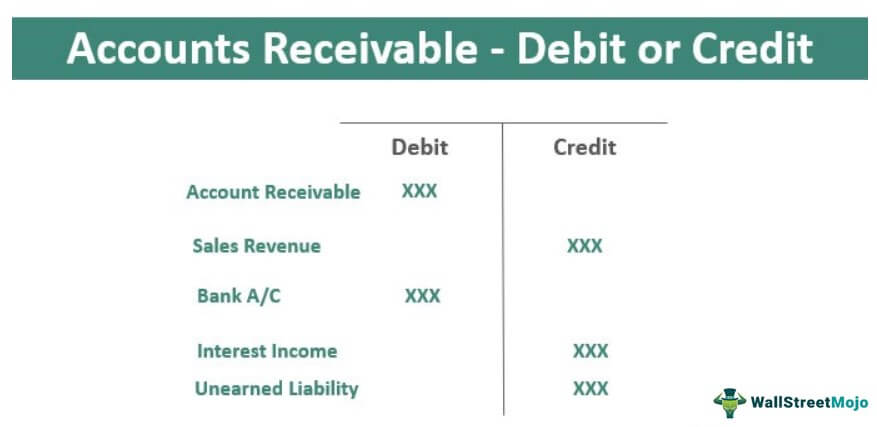

. The terms debit DR and credit CR have Latin roots. Accrual accounting records credits and debits at the time expenses or revenues are expected or accrued even when they are not yet received. Net Trade Receivables Total Credit Sales - Sales Discounts - Sales Returns - Sales Allowances - Collections.

Allowance for Doubtful Accounts. For cash accounting businesses record credits and debits when transactions occur and money passes hands. Back into Current Year BDE.

The accountants debit the accounts. Total credit sales including the 6450 will be posted from the Sales Day Book to the debit of trade receivables account and the credit of sales account. Debit comes from the word debitum meaning what is due and credit comes from creditum meaning something entrusted to another or a loan.

It is classified in the Balance Sheet as Current Asset since the entity has legal claim over this amount from its customers and the customer is legally bound to pay the same. Once the customer has paid the bill the company will credit the trade receivables account by 475 and debit the cash account. Working capital is calculated as current assets.

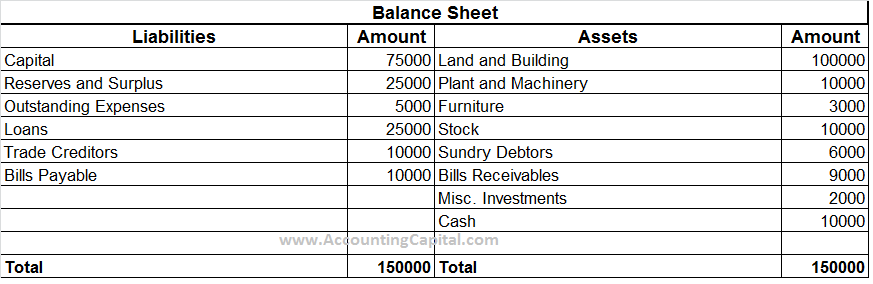

Trade Receivables 6000 sundry debtors 9000 bills receivable 15000. Ending balance beginning balance - Debit BDE and Credit Allowance. This creates accounting differences for trade credit.

Trade receivables and working capital. ACredit to allowance for doubtful accounts of 1100. A companys trade receivables or accounts receivable is an important consideration when it comes to calculating working capital.

Calculate Ending Balance in allowance. And credit the trade receivables account in the General Ledger. C 52Following the completion of an aging analysis the accountant for Liberty estimated that 1100 of the receivables would be uncollectible.

The relevant credit entry for the sale has already been made in the. The payment will also be credited to Manfredis account in the Receivables Ledger as shown in Table 2 below. CCredit to allowance for doubtful accounts of 1200.

The phrase refers to accounts a business has a. BDebit to bad debt expense of 900. A company also has non-trade receivables which are.

Aging of receivables method - BS approach. As mentioned earlier it can be seen that Trade Receivables and Other Receivables are categorized as Current Assets in balance sheet. Debit Trade receivables Credit Opening balance 175000 Transaction 5b 53550 from ECON 62 at Henry J.

There are a broad range of potential causes of debit balances. - emphasizes asset valuation. In addition debtors are treated.

Put simply a debit balance is an amount that is owed to you by a vendor. These are the amounts that are expected to be settled in less than 12 months. Trade Receivables and Other Receivables in the Balance Sheet.

Debtors are people or entities to whom goods have been sold or services have been provided on credit and payment is yet to be received for that. The debit balance is also a current asset because it meets the criteria in paragraph 66 of IAS 1. To put it simply Trade receivables arise when the entity sells goods and services to its customers on credit basis.

DDebit to bad debt expense of 1000. Yes in addition to credit balances you may also encounter debit balances. Example Trade Receivables.

Calculate trade receivables from the below balance sheet. Accounts receivable refers to the outstanding invoices a company has or the money the company is owed from its clients. Transaction 6 Trade Receivables Account Debit Credit To Sales AC INR 4 lakh from FAC 304 at Shiv Nadar University.

Accounts Receivable - AR. The original entry will be in Ingrids Sales Day Book which lists all credit sales chronologically.

Trade Receivables And Revenue Acca Global

Trade Payable And Trade Receivables With Example Accounting Capital

Is Accounts Receivable A Debit Or Credit Money Rook

Accounts Receivable Debit Or Credit Top Examples Treatment In Ifrs

Trade Receivables And Revenue Acca Global

Trade Receivables And Revenue Acca Global

0 Response to "Trade Receivables Debit or Credit"

Post a Comment